Your cart is currently empty!

What’s Really Affecting Your Credit Score?

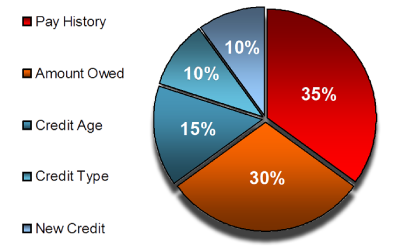

What factors are actually affecting your credit score? You’re not alone if you’ve ever looked at your number and felt perplexed or perhaps a bit irritated. When credit scores fluctuate from one month to the next, it can be difficult to determine why. In actuality, a number of unseen elements affect your score, some more than others. Being aware of these elements can have a significant impact. You can take actionable efforts to improve your score once you know what’s lowering it. Let’s examine the most frequent causes of your credit score not being where you would like it to be, as well as your options for fixing it.

🕒 Late Payments Might Be Affecting Your Credit Score More Than You Think

Your payment history is one of the main determinants of your credit score. Lenders want to see that you make your payments on schedule. Your grade may suffer if you frequently miss deadlines, even if it’s only by a few days.In reality, even one missed payment might appear on your credit report for years. It lets lenders know that there’s a chance you won’t pay them back.

- 💡Helpful tip: Try setting up automatic payments or phone reminders to stay on track with due dates. It’s an easy fix that has a significant effect.

💳 Carrying High Balances Could Be Affecting Your Credit Score

Another crucial factor is the proportion of your available credit that you are currently using. We refer to this as credit utilization. Assume you have a credit card balance of approximately $3,000 and the maximum is approximately $6,000. That is regarded as high as it indicates that you are utilizing 50% of your allotted credit. It is often advised by experts to maintain this ratio below 30%. The lower, the better. High use indicates to lenders that you may be experiencing financial strain.

- 💡 Helpful tip: If possible, pay down your balances regularly. You could also ask for a credit limit increase to bring the ratio down—just don’t spend more if your limit goes up!

A Short Credit History Might Be Affecting Your Credit Score

Your credit age, or how long you’ve had credit accounts, is another consideration. Lenders just don’t have enough information about you if you’re new to credit to evaluate your dependability in its entirety. A short credit history can still somewhat lower your score, even if you’re managing your accounts correctly. It’s also undesirable to have a shorter average credit age as a result of shutting older accounts.

- 💡Helpful tip: Keep old, unused credit cards open if they don’t charge a fee. They help show a longer, stable track record.

A Limited Mix of Credit Could Be Affecting Your Credit Score

Your types of credit accounts are also taken into account by credit scoring models. Having a range of debts, including credit cards, student loans, and auto loans, can slightly raise your credit score because it shows that you can manage several kinds of debt.If you have only ever used one type of credit card or loan, it may have a minor effect on your credit score.

- 💡Helpful tip: There’s no need to open new accounts just for variety, but over time, a healthy mix will naturally develop.

Too Many Credit Applications Are Likely Affecting Your Credit Score

The lender does a hard inquiry each time you apply for new credit, which may result in a slight decline in your credit score. A few queries in a short amount of time can give the impression that you are desperately looking for credit, even while one or two inquiries isn’t a huge concern.This could be interpreted by lenders as an indication that you are having financial difficulties.

- 💡Helpful tip: Apply for new credit strategically. Space out your applications, and only apply when it’s really necessary.

Mistakes on Your Credit Report May Be Quietly Affecting Your Credit Score

One unexpected factor that can be influencing your credit score is something you didn’t do: a reporting error.

These errors may include duplicate accounts, inaccurate balances, or payments that are mistakenly reported as late.You can find and fix these errors before they drastically reduce your credit score by routinely checking your credit report.

- 💡Helpful tip: You’re entitled to one free credit report each year from all three major bureaus—Experian, TransUnion, and Equifax. As soon as an error is noticed, file a dispute.

Closing Credit Cards Can End Up Affecting Your Credit Score

If you’re not using an old credit card, closing it could seem like the proper thing to do. However, doing so can potentially lower your score. The reason for this is because it can shorten your credit history and reduce the amount of credit you have available, which would increase your utilization ratio. Your credit score may suffer as a result of both of those modifications.

- 💡Helpful tip: Unless there’s an annual fee or another strong reason to close a card, it’s usually best to keep it open and active, even if you only use it for small purchases every few months.

Debt Settlements Could Be Affecting Your Credit Score Long-Term

Your credit score may be affected if you have ever had a charge-off or paid a debt for less than the entire amount. These marks inform lenders that you did not fulfill your initial payment plan, even if it may provide temporary respite.Rebuilding trust with lenders takes time, but it doesn’t mean you’re stuck forever.

- 💡Helpful tip: If you’re having trouble with payments, talk to your lender before things get worse. Some offer hardship programs that won’t hurt your credit as much.

Final Thoughts: Understanding What’s Affecting Your Credit Score Is the First Step

It’s not necessary for your credit score to be a mystery. Now that you know the common issues that could be affecting it—from late payments and high balances to short history and reporting errors—you’re better equipped to turn things around.

Making drastic changes all at once is not the goal of raising your score. It’s about small, consistent steps—paying on time, watching your balances, and keeping an eye on your report. Over time, those habits add up.

So next time you check your score, you’ll understand exactly what’s going on—and more importantly, what to do about it.

FAQs On “What’s Really Affecting Your Credit Score?”

How often does my credit score update?

Depending on when your lenders submit fresh information, your score is typically updated once a month. Sometimes, if you’ve been active recently, it might alter more frequently.

Will checking my own credit score hurt it?

Absolutely not. It is completely safe and has no effect on your score to check your own credit score. In actuality, monitoring your credit health is a wise practice.

How long do missed payments stay on my report?

A late payment may remain on your credit report for a maximum of seven years. However, if you keep up your timely payments, its effects gradually diminish

Can paying off a loan lower my score?

It can, but not for very long and just little. Since loan repayment closes an account, it may lower your score a little, but it’s still a good thing.

How can I quickly boost my credit score?

Making sure your credit report is error-free, paying all of your bills on time, and reducing any credit card debt are the quickest ways to improve your credit score.

Leave a Reply