Your cart is currently empty!

How Does a FICO Score Affect Loans?

How does a FICO score affect loans? It’s a typical query, particularly whether you’re applying for your first mortgage, auto loan, or credit card. Even though the subject might seem complex, knowing it can help you make better financial decisions and possibly save you money over time. Let’s examine how your borrowing experience can be significantly impacted by this small three-digit number.

Table of Contents

First Things First—What Is a FICO Score?

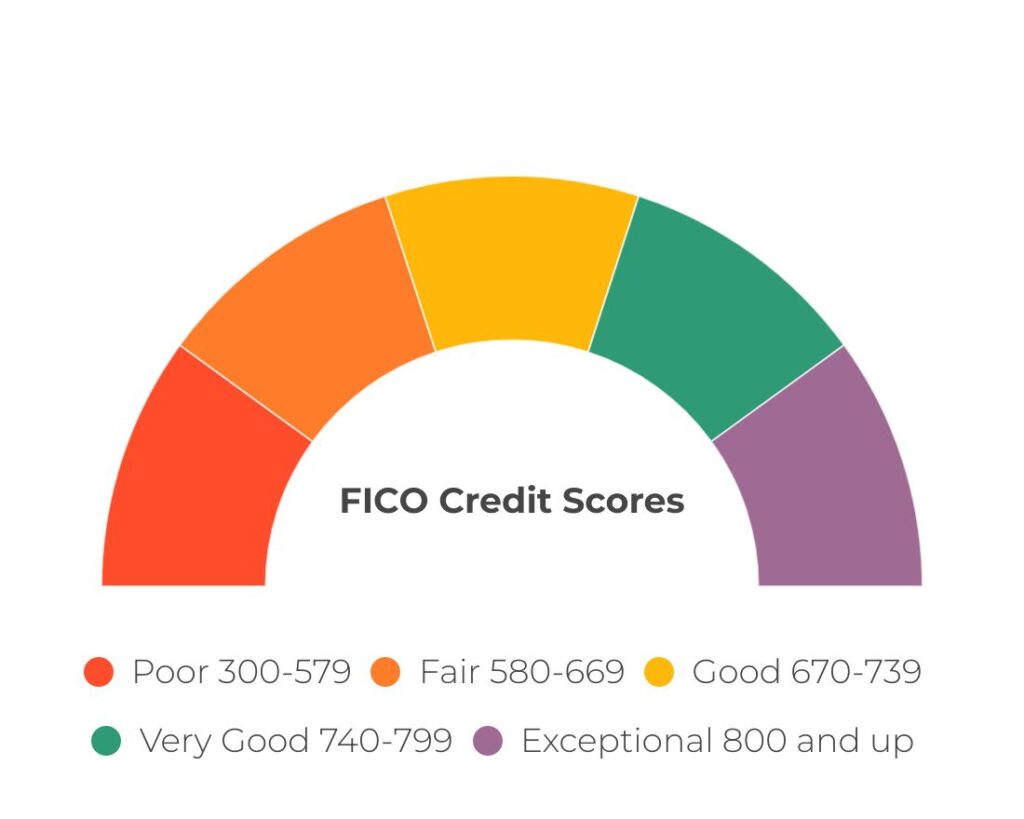

Let’s begin with the fundamentals. A credit score that falls between 300 and 850 is known as a FICO score. It demonstrates how well you manage borrowed money. Your payment history, the amount you owe, the length of time you’ve had credit, and a few other variables are used to calculate this score. To put it simply, lenders utilize it to determine your likelihood of repaying them. Their opinion of you improves with a higher score.

Why It Matters to Lenders

The lender doesn’t have time to sit down and learn about you when you apply for a loan. They examine your FICO score instead. It gives them a quick rundown of your financial background. A high score indicates that you have handled your money sensibly. That can increase your chances of being accepted, frequently on more favorable terms.

How Does a FICO Score Affect Loans and Your Approval Odds?

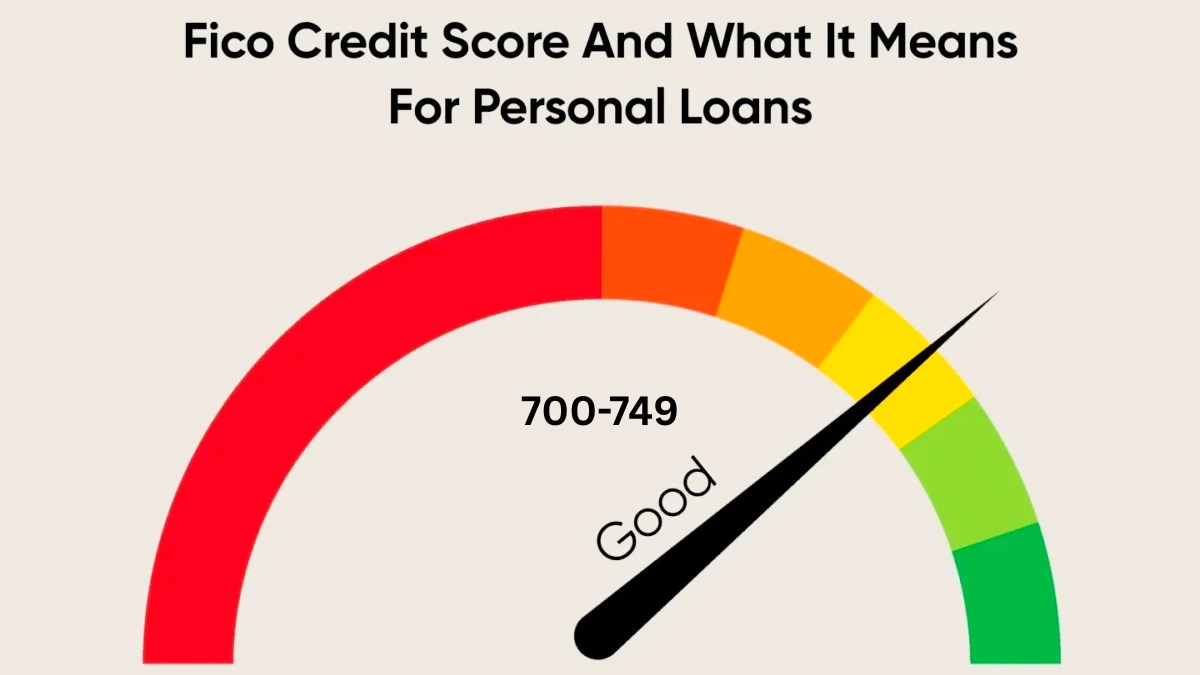

Your score can make or break a loan application. For various loan kinds, lenders typically have minimum score criteria. You have a strong probability of getting approved if your score is “in the good to outstanding range (typically 670 and up)”. However, you may be rejected or requested to submit additional paperwork, a greater down payment, or a co-signer if your score is on the lower end. The loan terms may not be perfect even if you are approved.

Your Interest Rate Depends on That Score

This is a crucial section because the interest rate that you will be offered is greatly influenced by your FICO score. With a lower rate, which is often linked to a higher score, you can save thousands of dollars over the course of the loan. Conversely, lenders may still approve your loan even if your credit score is low, but the interest rate will be much higher. That additional interest quickly mounts up, transforming a modest debt into an expensive burden.

How Does a FICO Score Affect Loans in Terms of Borrowing Power?

Your score has an impact on more than just your approval or rate. It affects “the amount you can borrow” as well. Lenders may be more inclined to lend you money if you have a better score because it gives them greater confidence. A lower score makes them more cautious and may result in a smaller loan amount, perhaps insufficient to meet your entire needs.

Which Loans Are Influenced by FICO Scores?

Your FICO score is used in some capacity by almost all loan types. This is how it functions in typical lending scenarios:

- Auto loans: Better terms and rates are associated with higher scores.

- Mortgages: Your score can affect your down payment and mortgage insurance in addition to approval.

- Personal loans: Your credit score counts whether you’re borrowing money for a wedding or unexpected costs.

- Credit cards: Your score determines your credit limit, approval, and even benefits.

- Private student loans: Your FICO score is taken into consideration because, in contrast to federal loans, these need a credit check.

Simple Ways to Boost Your FICO Score Before Applying

The good news is that it won’t be permanent if your score isn’t where you want it to be. You can take certain actions to make it better.Make sure you’re paying all of your bills on time first. Payment history matters a lot. Next, make an effort to reduce your total debt, particularly that incurred via credit cards. Don’t apply for too much new credit at once, either. Additionally, keep in mind that errors occur more frequently than you might imagine, so be sure to examine your credit report for them.When you’re applying for a loan, even little upgrades can have an impact.

Conclusion

Although your FICO score is important, it doesn’t determine who you are. It’s just one method used by lenders to assess risk, and it may evolve over time. You’re better equipped to make informed borrowing decisions now that you understand how a FICO score impacts loans. When looking for a loan, don’t be scared to ask questions, be informed, and keep improving your credit.

FAQs On How Does a FICO Score Affect Loans?

-

What’s Considered a Good FICO Score When Applying for a Loan?

Your chances of being approved for most loans are generally good if your FICO score is 670 or higher. Lenders typically view you as a solid borrower who is likely to make timely repayments after your score falls within the 740 and 799 range. You’re in the top tier, which is where the best rates and loan offers are typically found, assuming you’re fortunate enough to have a score above 800.

-

Can I Still Get a Loan If My FICO Score Is Low?

Although it might not be easy, it is absolutely feasible to obtain a loan with a low credit score. You may encounter lower borrowing limits, higher interest rates, or a request for a co-signer. You still have options, though, as certain lenders specialize in helping borrowers who are attempting to restore or rebuild their credit.

-

How Long Does It Take to Improve a FICO Score?

Small changes can start to appear within a few months if you start paying all of your payments on time and reduce your credit card debt. However, raising your FICO score takes time. However, depending on your starting place and credit practices, more substantial gains may take three to six months or longer.

-

Do All Loan Types Use My FICO Score?

Your FICO score is used by the majority of lenders to determine your eligibility and interest rate, including those that offer personal loans, credit cards, auto loans, and mortgages. Federal student loans are one exception, often not requiring a credit check. However, if you’re thinking about taking out a private student loan, your score matters.

-

Does Checking My Own FICO Score Hurt My Credit?

Absolutely not. Checking your own FICO score is regarded as a soft inquiry and has no bearing whatsoever on your credit. In actuality, checking it frequently is a great habit. In this manner, you can monitor your development and identify any mistakes before they become an issue.

Leave a Reply